What Flooring Installers Need to Know About Liability Insurance: A Comprehensive Guide

Embarking on the journey of understanding Liability Insurance for Flooring Installers, this informative guide aims to shed light on crucial aspects that every installer should be aware of.

Delving into the nuances of liability insurance and its implications in the flooring industry, this guide serves as a beacon of knowledge for both seasoned professionals and newcomers alike.

What is Liability Insurance for Flooring Installers?

Liability insurance for flooring installers is a type of insurance coverage that protects professionals in the flooring installation industry from financial losses resulting from third-party claims of property damage, bodily injury, or other related incidents that may occur during their work.

Having liability insurance is crucial for flooring installers as it provides a safety net against potential legal claims and lawsuits that could arise due to accidents, mistakes, or unforeseen circumstances on the job. It offers financial protection and peace of mind, allowing installers to focus on their work without the constant worry of potential liabilities.

Importance of Liability Insurance in the Flooring Installation Industry

- Liability insurance helps cover legal expenses, court costs, and settlements in the event of a lawsuit filed against a flooring installer.

- It ensures that installers are protected from financial ruin in case of accidents or damages caused to a client's property during the installation process.

- Having liability insurance can enhance the credibility and professionalism of flooring installers, reassuring clients that they are covered in case of any mishaps.

Examples of Situations Where Liability Insurance Protects Flooring Installers

- Accidentally damaging a customer's expensive flooring materials during installation.

- A client or a third-party getting injured on the job site due to a slip or fall caused by the installer's work.

- Claims of improper installation leading to damages or accidents after the project is completed.

Types of Liability Insurance Coverage

When it comes to liability insurance, flooring installers have a few different options to choose from. Understanding the types of coverage available can help protect your business in various situations.

General Liability Insurance

General liability insurance is a foundational policy that covers common risks faced by flooring installers. This type of coverage typically includes protection against third-party bodily injury, property damage, and advertising injury claims. For example, if a customer slips and falls while your team is working on a project, general liability insurance can help cover medical expenses and legal fees.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is designed to protect flooring installers from claims related to professional mistakes or negligence. This type of coverage can be especially beneficial for contractors who provide design advice or consulting services in addition to installation.

For instance, if a client alleges that your workmanship was faulty and caused damage to their property, professional liability insurance can help cover the costs of defending against the claim.

Benefits of Each Type of Coverage

- General liability insurance provides essential protection against common accidents and injuries that can occur on the job site, giving you peace of mind knowing that your business is covered.

- Professional liability insurance offers specialized coverage for claims arising from professional errors or omissions, safeguarding your reputation and finances in case of disputes with clients.

- By having both types of coverage, flooring installers can ensure comprehensive protection against a wide range of risks, from property damage to legal liabilities.

Factors to Consider When Choosing Liability Insurance

When selecting liability insurance as a flooring installer, it is crucial to take into account several key factors that can greatly impact your coverage and financial security. Understanding how coverage limits, deductibles, premiums, endorsements, and exclusions work can help you make an informed decision that best suits your needs.

Coverage Limits

One of the most important factors to consider when choosing liability insurance is the coverage limits. This refers to the maximum amount your insurance provider will pay out for a covered claim. It is essential to assess your potential risks and choose coverage limits that adequately protect you in case of a lawsuit or damage claim.

Deductibles and Premiums

Deductibles are the amount you are required to pay out of pocket before your insurance coverage kicks in. Lower deductibles usually result in higher premiums, while higher deductibles can lower your premiums but require you to pay more in case of a claim.

It's essential to strike a balance between deductibles and premiums that align with your budget and risk tolerance.

Insurance Endorsements and Exclusions

Insurance endorsements are additional coverages that can be added to your policy to tailor it to your specific needs. On the other hand, exclusions are specific situations or risks that are not covered by your insurance policy. Understanding what is included and excluded in your policy is crucial to avoid any surprises when filing a claim.

Claims Process and Coverage Limitations

When it comes to liability insurance for flooring installers, understanding the claims process and coverage limitations is crucial for ensuring smooth operations and protection against unforeseen risks.

Typical Claims Process for Flooring Installers

- When a claim arises, the first step is to notify your insurance provider as soon as possible.

- The insurance company will then investigate the claim to determine its validity and coverage under your policy.

- If the claim is approved, the insurance company will work with you to provide financial support for legal fees, settlements, or damages incurred.

- It is essential to cooperate fully with the insurance company throughout the claims process to ensure a favorable outcome.

Common Limitations on Coverage

- Some liability insurance policies may have exclusions for certain types of claims, such as intentional acts or environmental damage.

- Coverage limitations may also apply to specific situations, such as claims related to subcontractor work or faulty installation.

- It is important to review your policy carefully to understand any limitations on coverage that may apply to your business.

Tips for Ensuring Smooth Claims Processing

- Keep detailed records of all work performed, including contracts, invoices, and communication with clients.

- Report any incidents or potential claims to your insurance provider promptly to avoid delays in processing.

- Work closely with your insurance agent to understand your policy coverage and any steps required during the claims process.

- Consider working with a reputable insurance provider that specializes in liability coverage for flooring installers to ensure adequate protection.

Importance of Proper Documentation

Proper documentation is crucial for flooring installers when it comes to liability insurance. It serves as evidence and support in the event of a claim, helping to protect the installer's interests and ensure a smooth claims process.

Essential Documents for Insurance Claims

- Contracts and agreements with clients: These documents Artikel the scope of work, responsibilities, and terms agreed upon between the installer and the client.

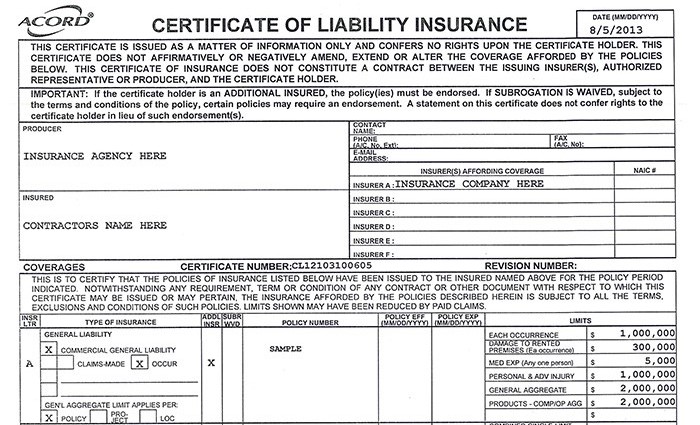

- Proof of insurance coverage: Keeping a record of your liability insurance policy and any updates or changes is essential for quick reference during a claim.

- Work logs and project details: Documenting the work done, materials used, and any issues encountered during the installation process can provide valuable information during a claim.

- Communication records: Emails, text messages, and notes regarding discussions with clients or other parties involved in the project can support your case in case of disputes.

- Incident reports: If any accidents, damages, or injuries occur during a project, thorough incident reports should be filed and documented.

Organizing and Storing Documentation Effectively

- Use a digital filing system: Scan and store important documents electronically to ensure easy access and backup in case of loss or damage.

- Categorize documents by project: Organize your documentation by project to quickly locate relevant information when needed.

- Regularly update and review documents: Make sure all documentation is current and accurate, and periodically review to identify any gaps or missing information.

- Secure physical copies: For documents that require original signatures or hard copies, keep them in a secure and organized filing system.

Closing Summary

In conclusion, grasping the intricacies of liability insurance is paramount for flooring installers to safeguard their business and livelihood. This guide equips you with the necessary information to navigate the complexities of insurance coverage with confidence.

FAQ Insights

What are the key benefits of professional liability insurance for flooring installers?

Professional liability insurance protects flooring installers against claims of negligence, errors, or omissions in their work, providing financial coverage for legal expenses and settlements.

How do coverage limits impact the choice of liability insurance for flooring installers?

Coverage limits dictate the maximum amount an insurance company will pay for a covered claim. Flooring installers should assess their business needs and potential risks to determine appropriate coverage limits.

What documents should flooring installers maintain for insurance claims?

Essential documents include contracts, invoices, proof of insurance, incident reports, and communication records. Keeping thorough documentation is crucial for smooth claims processing.