How to Find the Cheapest Auto Insurance with Full Coverage

Delving into the realm of auto insurance, this guide uncovers the secrets to securing the most affordable full coverage policies. Get ready for a journey filled with valuable insights and tips to navigate the complex world of insurance with ease.

Understanding Auto Insurance

Auto insurance is a necessity for drivers to protect themselves financially in case of accidents or other unforeseen events. Full coverage auto insurance typically includes a combination of liability coverage, collision coverage, and comprehensive coverage.

What Full Coverage Auto Insurance Typically Includes:

- Liability coverage: This helps cover costs if you're responsible for injuring someone or damaging their property in an accident.

- Collision coverage: This helps pay for repairs to your own vehicle after a collision, regardless of who is at fault.

- Comprehensive coverage: This helps cover damages to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

The Importance of Having Full Coverage Auto Insurance:

Having full coverage auto insurance provides peace of mind knowing that you have financial protection in various situations. It can help you avoid significant out-of-pocket expenses in case of accidents or damage to your vehicle.

Factors That Affect Auto Insurance Rates:

- Your driving record: A clean driving record typically leads to lower insurance rates, while accidents and traffic violations can increase premiums.

- Your age and experience: Younger and less experienced drivers usually pay higher insurance rates due to a higher risk of accidents.

- The type of vehicle you drive: The make and model of your vehicle, as well as its safety features, can impact your insurance rates.

- Your location: Insurance rates can vary based on where you live, with factors like crime rates and traffic congestion taken into account.

- The coverage limits and deductibles you choose: Higher coverage limits and lower deductibles often result in higher premiums.

Researching Auto Insurance Providers

When looking for affordable full coverage auto insurance, it's essential to research different insurance providers to find the best option for your needs and budget.

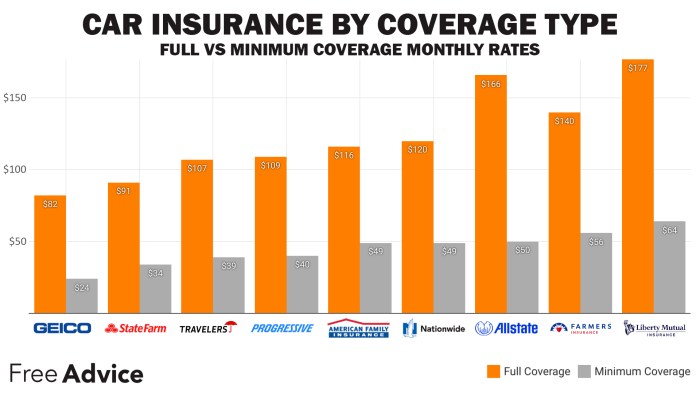

Top Auto Insurance Companies for Affordable Full Coverage

- State Farm

- Geico

- Progressive

- Allstate

- USAA (for military members and their families)

Comparing Quotes from Different Insurance Providers

- Request quotes from multiple insurance companies to compare prices.

- Consider the coverage limits and deductibles offered by each provider.

- Look for discounts that may be available based on your driving record, age, or other factors.

- Review the terms and conditions of each policy to ensure you're getting the coverage you need.

Finding Reputable Insurance Companies

- Check the financial stability of the insurance company by looking at their ratings from agencies like A.M. Best or Moody's.

- Read reviews and testimonials from customers to gauge the level of customer satisfaction.

- Verify that the insurance company is licensed to operate in your state.

- Consider the customer service reputation of the insurance provider.

Utilizing Discounts and Savings

When it comes to finding the cheapest auto insurance with full coverage, taking advantage of discounts and savings can significantly reduce your premiums. Insurance providers offer various discounts that can help you save money on your policy. Additionally, bundling policies and maintaining a good driving record can also lead to substantial savings.

Common Discounts Available for Auto Insurance

- Multi-policy discount: Combining your auto insurance with another type of insurance, such as homeowners or renters insurance, from the same provider can qualify you for a discount.

- Good student discount: If you are a student with good grades, you may be eligible for a discount on your auto insurance.

- Safe driver discount: Having a clean driving record with no accidents or traffic violations can lead to lower premiums.

- Affiliation discounts: Some insurance companies offer discounts to members of certain organizations or affiliations.

- Low mileage discount: If you do not drive your car often, you may qualify for a low mileage discount.

Bundling Policies for Savings

- By bundling your auto insurance with other insurance policies, such as home or renters insurance, you can often receive a discount on each policy.

- Insurance companies offer discounts to customers who purchase multiple policies from them as it increases customer loyalty and reduces administrative costs.

Impact of a Good Driving Record on Insurance Premiums

Maintaining a good driving record is crucial for keeping your auto insurance premiums low. Insurance companies consider drivers with a clean record to be less risky, leading to lower premiums. Avoiding accidents, traffic violations, and DUIs can help you secure the best rates on your auto insurance policy.

Adjusting Coverage and Deductibles

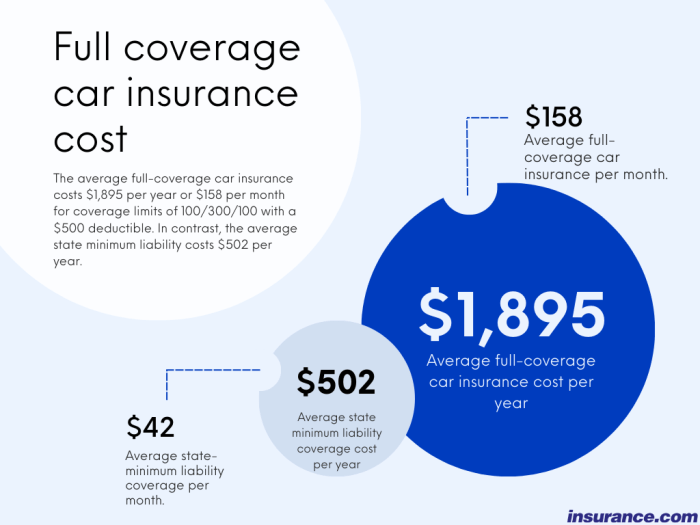

When it comes to finding the cheapest auto insurance with full coverage, adjusting your coverage levels and deductibles can play a significant role in determining your insurance costs. Understanding the relationship between these factors is crucial in making informed decisions to save money on your auto insurance premiums.

Impact of Adjusting Coverage Levels

- Increasing your coverage levels, such as opting for higher liability limits or adding comprehensive and collision coverage, will typically result in higher insurance premiums. This is because you are expanding the protection provided by your policy, which comes at an additional cost.

- On the other hand, decreasing your coverage levels can lead to lower insurance premiums. However, it's important to assess your individual needs and risk tolerance to ensure you have adequate coverage in case of an accident.

Relationship between Deductible Amounts and Premiums

- Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in to cover the rest of the claim. Choosing a higher deductible will lower your premiums, as you are taking on more financial responsibility in the event of a claim.

- Conversely, selecting a lower deductible will result in higher premiums since the insurance company will have to cover a larger portion of the claim. It's essential to weigh the savings on premiums against the potential out-of-pocket costs when deciding on a deductible amount.

Pros and Cons of Choosing Higher or Lower Deductibles

- Higher Deductibles:

- Pros: Lower insurance premiums, cost-effective for safe drivers with minimal risk of accidents, can save money over time if no claims are filed.

- Cons: Higher out-of-pocket expenses in the event of a claim, may not be financially feasible for some drivers, could lead to financial strain after an accident.

- Lower Deductibles:

- Pros: Lower out-of-pocket costs when filing a claim, more affordable in case of an accident, suitable for drivers who prefer a higher level of protection.

- Cons: Higher insurance premiums, may not be cost-effective in the long run if frequent claims are filed, could result in overpaying for coverage.

Understanding Coverage Limits

When it comes to auto insurance, coverage limits play a crucial role in determining how much protection you have in case of an accident or other covered event. These limits essentially represent the maximum amount your insurance provider will pay for a claim.

It is important to understand the impact of coverage limits on insurance costs and choose appropriate limits based on your needs and budget.

Importance of Choosing Appropriate Coverage Limits

Determining the right coverage limits is essential to ensure you have adequate protection without overpaying for unnecessary coverage. For example, setting low liability limits may result in insufficient coverage if you are involved in a serious accident where damages exceed your limits.

On the other hand, opting for high coverage limits can provide greater financial protection but may come with higher premiums. It is crucial to strike a balance between coverage and cost to meet your individual needs.

Examples of How Different Coverage Limits Affect Premiums

- Low Coverage Limits: If you choose minimal coverage limits, such as the state's minimum requirements, your premiums may be lower but you risk being underinsured in case of a significant accident.

- Medium Coverage Limits: Opting for moderate coverage limits can offer a balance between protection and affordability. Your premiums may be slightly higher compared to minimum coverage, but you have more financial security.

- High Coverage Limits: Selecting high coverage limits means you have extensive protection against costly damages or injuries. However, this choice typically results in higher premiums due to the increased level of coverage provided.

Concluding Remarks

As we wrap up our discussion on finding the cheapest auto insurance with full coverage, remember that knowledge is power when it comes to making the best decisions for your insurance needs. Armed with the right information, you can confidently choose a policy that offers both protection and savings.

Helpful Answers

What factors affect auto insurance rates?

Auto insurance rates can be influenced by various factors such as age, driving record, location, and the type of vehicle being insured.

How can bundling policies help save on auto insurance?

Bundling policies, such as combining auto and home insurance with the same provider, often leads to discounts on both policies, resulting in overall savings.

What is the relationship between deductible amounts and premiums?

Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums. It's important to strike a balance based on your financial situation.

Why is choosing appropriate coverage limits important?

Choosing the right coverage limits ensures you have adequate protection in case of an accident without overpaying for coverage you don't need.