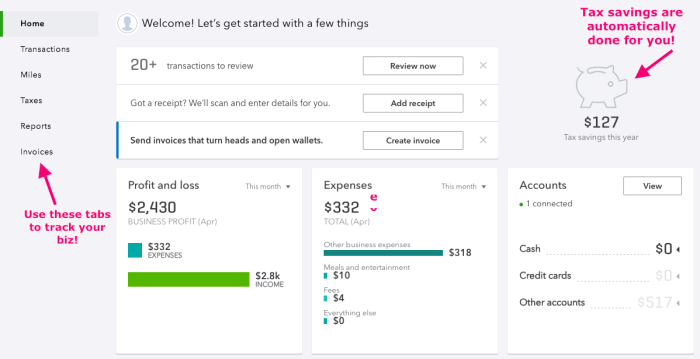

Exploring the ways in which QuickBooks Self Employed can streamline tax processes for freelancers, this introduction sets the stage for a detailed and informative discussion that will benefit those navigating the complexities of freelance taxes.

The following paragraphs will delve into the specific features and functionalities of QuickBooks Self Employed that make it a valuable tool for simplifying freelancer taxes.

Benefits of Using QuickBooks Self-Employed for Freelancer Taxes

QuickBooks Self-Employed offers a range of benefits for freelancers when it comes to simplifying tax-related tasks. From streamlined income and expense tracking to automated categorization, freelancers can save time and effort in managing their finances effectively.

Automated Categorization Feature

QuickBooks Self-Employed's automated categorization feature is a game-changer for freelancers. It helps in organizing transactions into appropriate categories, making it easier to track income and expenses. This feature also ensures that tax preparation becomes more efficient and accurate, reducing the chances of errors.

Mileage Tracking Feature

The mileage tracking feature in QuickBooks Self-Employed is particularly beneficial for freelancers who need to travel for work. By automatically tracking mileage, freelancers can easily maximize deductions for business-related travel expenses. This feature not only saves time but also helps freelancers save money by ensuring they claim all eligible deductions.

Tax Deductions Made Easy with QuickBooks Self-Employed

When it comes to tax deductions, freelancers have the opportunity to save money by claiming expenses related to their business. However, keeping track of these deductions can be a daunting task without the right tools.QuickBooks Self-Employed simplifies the process by allowing freelancers to categorize and track their expenses effortlessly.

This not only saves time but also ensures that no deductible expense is overlooked, ultimately maximizing tax savings.

Common Tax Deductions for Freelancers

- Home office expenses, including rent, utilities, and internet costs.

- Business-related travel expenses, such as mileage, meals, and accommodation.

- Professional services fees, like legal or accounting services.

- Health insurance premiums for self-employed individuals.

How QuickBooks Self-Employed Helps with Deductions

- Automated expense tracking and categorization for easy deduction management.

- Mileage tracking feature to ensure accurate reporting of travel expenses.

- Integration with bank accounts and credit cards to capture all business-related transactions.

- Reports and summaries that simplify tax preparation by consolidating deductible expenses.

Examples of Overlooked Deductible Expenses

- Software and tools used for business purposes.

- Continuing education or training related to the freelancer's field.

- Marketing and advertising expenses to promote the freelancer's services.

- Office supplies and equipment necessary for conducting business.

Simplifying Quarterly Estimated Taxes for Freelancers

As a freelancer, it's important to understand and stay on top of your quarterly estimated taxes to avoid penalties and ensure smooth financial planning

How QuickBooks Self-Employed Can Help

QuickBooks Self-Employed can simplify the process of calculating and planning for quarterly tax payments in the following ways:

- Automated Tracking: QuickBooks Self-Employed automatically tracks your income and expenses, making it easier to estimate your quarterly tax payments accurately.

- Tax Payment Reminders: The software sends reminders when estimated tax payments are due, helping you stay organized and avoid missing deadlines.

- Calculating Deductions: QuickBooks Self-Employed helps you identify potential deductions that can reduce your taxable income, leading to lower quarterly tax payments.

Tips for Avoiding Penalties

Here are some tips on using QuickBooks Self-Employed to avoid penalties for underpayment of estimated taxes:

- Regularly Update Income and Expenses: Keep your financial records up to date in QuickBooks Self-Employed to ensure accurate calculations for quarterly tax payments.

- Review Tax Reports: Periodically review tax reports generated by the software to identify any discrepancies or opportunities for deductions.

- Consult a Tax Professional: If you're unsure about how to calculate your quarterly estimated taxes, consider consulting a tax professional who can provide guidance based on your specific financial situation.

Enhancing Tax Filing Efficiency with QuickBooks Self-Employed

Managing taxes as a freelancer can be overwhelming, but QuickBooks Self-Employed offers a solution to streamline the tax filing process and make it more efficient.

Generating Tax Reports and Exporting Data

- QuickBooks Self-Employed allows freelancers to generate detailed tax reports, including income and expenses, making it easier to track and organize financial information.

- Users can export these reports directly to tax preparation software or share them with their tax professionals, saving time and ensuring accuracy during tax filing.

Integration with Tax Filing Platforms

- QuickBooks Self-Employed seamlessly integrates with popular tax filing platforms like TurboTax, making it convenient for freelancers to transfer their financial data and file taxes electronically.

- By connecting QuickBooks Self-Employed with tax software, freelancers can ensure that all deductions and expenses are accurately reflected in their tax returns, minimizing errors and maximizing savings.

Conclusive Thoughts

In conclusion, QuickBooks Self Employed emerges as a powerful ally for freelancers looking to manage their taxes efficiently and accurately. By leveraging its capabilities, individuals can navigate tax obligations with ease and confidence.

User Queries

How does QuickBooks Self-Employed simplify income and expense tracking for freelancers?

QuickBooks Self-Employed provides a user-friendly platform that allows freelancers to easily categorize income and expenses, ensuring accurate financial records for tax purposes.

What are some examples of deductible expenses that freelancers often overlook?

Commonly overlooked deductible expenses for freelancers include home office expenses, professional development costs, and travel expenses related to client meetings.

How can QuickBooks Self-Employed assist in calculating and planning for quarterly tax payments?

The software can track income throughout the year and provide estimates for quarterly tax payments, helping freelancers avoid surprises and plan their finances effectively.

Can QuickBooks Self-Employed integrate with tax filing platforms for seamless submission?

Yes, QuickBooks Self-Employed offers integration with various tax filing platforms, streamlining the process of submitting tax returns and ensuring accuracy in financial reporting.

![[Infographic] 5 Key Workflow Automation Trends | Quixy](https://management.radarcirebon.tv/wp-content/uploads/2025/10/The-Rise-of-Workflow-Automation-5-Key-Trends-to-Keep-Your-Business-Ahead--120x86.png)

![Checklist: How to protect your digital life [PMP #136] - Paul Minors](https://management.radarcirebon.tv/wp-content/uploads/2025/10/checklist-protect-your-digital-life-120x86.jpg)

![Checklist: How to protect your digital life [PMP #136] - Paul Minors](https://management.radarcirebon.tv/wp-content/uploads/2025/10/checklist-protect-your-digital-life-350x250.jpg)