Coverage Gaps to Avoid in Small Business Policies: A Comprehensive Guide

Delving into the realm of small business insurance, the focus shifts to Coverage Gaps to Avoid in Small Business Policies. This crucial aspect often overlooked can have significant repercussions, making it essential to explore and understand thoroughly.

As we navigate through the intricacies of common coverage gaps, property insurance gaps, liability coverage gaps, and cyber insurance gaps, the importance of proactive measures becomes evident.

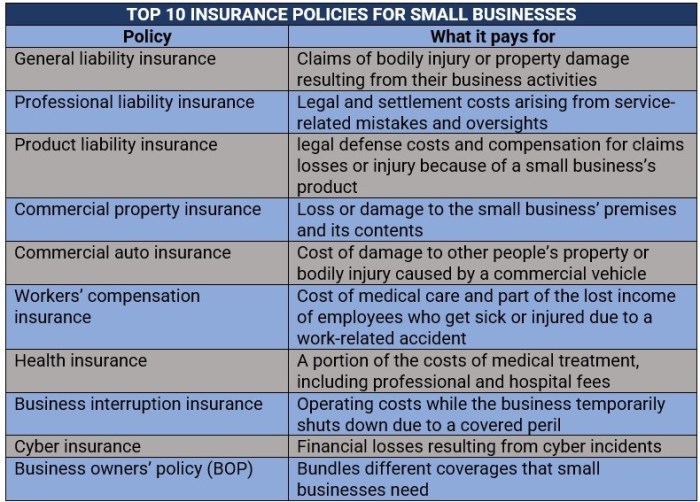

Common Coverage Gaps

When it comes to small business insurance policies, there are certain coverage gaps that are often overlooked, leaving the business vulnerable to risks and financial losses. Addressing these gaps proactively is crucial to ensure adequate protection for the business.

Lack of Business Interruption Insurance

Business interruption insurance is often disregarded by small businesses, but it is essential in case the business operations are disrupted due to unforeseen events such as natural disasters, fires, or other incidents. Without this coverage, the business may struggle to recover financially during the downtime.

Underinsured or Uninsured Equipment and Inventory

Small businesses may underestimate the value of their equipment and inventory, leading to being underinsured or even completely uninsured in case of theft, damage, or loss. This gap can result in significant financial losses that may be challenging to recover from without proper coverage.

Professional Liability Coverage

Professional liability coverage, also known as errors and omissions insurance, is often overlooked by small businesses that provide services or advice. Without this coverage, the business may face legal expenses and damages if a client sues for negligence or errors in the services provided.

It is crucial to have this coverage to protect the business's reputation and financial stability.

Cyber Liability Insurance

In today's digital age, small businesses are increasingly becoming targets of cyber-attacks and data breaches. However, many small businesses do not have cyber liability insurance to cover the costs associated with such incidents, including data recovery, legal fees, and customer notification expenses.

Addressing this gap proactively is essential to safeguard sensitive information and maintain trust with customers.

Workers' Compensation Insurance

Small businesses with employees must have workers' compensation insurance to provide coverage for employee injuries or illnesses that occur on the job. Failure to have this coverage can result in legal penalties, fines, and potential lawsuits from employees seeking compensation for work-related injuries.

It is crucial for small businesses to address this coverage gap to protect both their employees and their business.

Property Insurance Gaps

Property insurance is crucial for small businesses to protect their physical assets from various risks. However, there are certain gaps in property insurance coverage that business owners should be aware of to avoid potential financial losses.These gaps in property insurance can lead to significant financial consequences for small businesses if not addressed properly.

For instance, if a small business experiences a fire that damages the building and equipment, but the insurance policy does not cover business interruption, the business may suffer from loss of income during the recovery period. Similarly, if a policy only covers certain types of perils like fire and theft, but not natural disasters like floods or earthquakes, the business could face substantial losses in the event of such events.To ensure comprehensive coverage for their property, small business owners should consider the following strategies:

Regularly Review and Update Coverage

Small business owners should regularly review their property insurance policies to ensure that they have adequate coverage for all potential risks. As the business grows or changes, the insurance needs may also evolve, so it is essential to update the policy accordingly.

Consider Business Interruption Insurance

Business interruption insurance is a valuable addition to property insurance as it covers the loss of income that a business may experience due to a covered peril. This coverage can help small businesses stay afloat during the recovery period after a disaster.

Include Coverage for Natural Disasters

It is important for small business owners to ensure that their property insurance policy includes coverage for natural disasters like floods, earthquakes, hurricanes, and tornadoes. These events can cause significant damage to the property, and having adequate coverage can help mitigate financial losses.By addressing these property insurance gaps and taking proactive steps to ensure comprehensive coverage, small business owners can protect their assets and financial stability in the face of unforeseen events.

Liability Coverage Gaps

When it comes to small business insurance policies, liability coverage is crucial to protect the business from potential lawsuits and claims. However, there are certain gaps in liability coverage that small business owners need to be aware of in order to ensure adequate protection.Inadequate liability coverage can have serious consequences for a small business, including financial losses, damage to reputation, and even the risk of bankruptcy.

On the other hand, comprehensive liability coverage can provide peace of mind and protection against a wide range of risks.

Types of Liability Coverage Gaps

- Professional Liability: Also known as errors and omissions insurance, this type of coverage protects businesses from claims of negligence or inadequate work performance.

- Product Liability: Covers businesses in case their products cause harm or injury to customers.

- Cyber Liability: Protects against data breaches, cyber-attacks, and other online risks that can result in financial losses and damage to reputation.

Consequences of Inadequate Liability Coverage

- Legal Costs: Without adequate coverage, businesses may have to bear the costs of legal fees and settlements out of pocket.

- Reputation Damage: Being involved in a lawsuit can harm a business's reputation and lead to loss of customers and trust.

- Financial Losses: Inadequate coverage can result in significant financial losses that may threaten the survival of the business.

Strategies to Mitigate Liability Coverage Gaps

- Assess Risks: Identify potential liabilities specific to your business and ensure you have the appropriate coverage.

- Review Policies Regularly: Stay informed about changes in your business operations and update your insurance policies accordingly.

- Work with an Insurance Agent: Consult with an experienced insurance agent to understand your coverage needs and find the right policies for your business.

Cyber Insurance Gaps

In today's digital landscape, cyber insurance has become increasingly important for small businesses to protect themselves from cyber threats. However, there are potential gaps in cyber insurance coverage that business owners need to be aware of to ensure they are adequately protected.

Importance of Cyber Insurance

Cyber insurance is essential for small businesses as it provides coverage for expenses related to cyber-attacks, data breaches, and other cyber incidents. Without proper cyber insurance, a small business could face significant financial losses and reputational damage.

Enhancing Cyber Insurance Coverage

- Regularly review and update your cyber insurance policy to ensure it aligns with your business's evolving needs and any changes in the cyber threat landscape.

- Consider adding coverage for business interruption, ransomware attacks, and social engineering scams to fill potential gaps in your cyber insurance policy.

- Work with an experienced insurance agent or broker who specializes in cyber insurance to help identify any coverage gaps and tailor a policy that meets your specific needs.

- Invest in cybersecurity measures and employee training to reduce the likelihood of a cyber incident, ultimately lowering your cyber insurance premiums and potential gaps in coverage.

Last Recap

In conclusion, addressing Coverage Gaps to Avoid in Small Business Policies is not just a choice but a necessity for safeguarding a small business's financial well-being. By staying informed and taking preventive actions, small business owners can protect their ventures from potential risks and losses.

FAQ Insights

What are some common coverage gaps in small business policies?

Common coverage gaps include lack of business interruption coverage, errors and omissions exclusions, and inadequate cyber insurance.

How can small business owners ensure comprehensive property insurance coverage?

Small business owners can ensure comprehensive property insurance coverage by conducting regular assessments of their property value, updating their policies accordingly, and considering additional coverage options like business income insurance.

What are the consequences of having inadequate liability coverage for small businesses?

Inadequate liability coverage can expose small businesses to lawsuits, financial liabilities, and reputational damage that can jeopardize their operations and existence.

How can small businesses enhance their cyber insurance coverage to avoid gaps?

Small businesses can enhance their cyber insurance coverage by conducting regular cybersecurity assessments, investing in employee training, and staying informed about emerging cyber threats and trends.