Best Affordable Life Insurance for Over 50s in 2025: A Comprehensive Guide

Exploring the realm of Best Affordable Life Insurance for Over 50s in 2025, this introduction sets the stage for an in-depth look at the key considerations and options available. With a mix of informative insights and practical advice, readers are sure to gain valuable knowledge on navigating life insurance choices for those over 50.

In the subsequent paragraphs, we will delve into the factors influencing life insurance decisions, the types of policies suitable for individuals in this age group, top insurance companies offering affordable options, and the latest trends shaping the industry in 2025.

Factors to Consider when Choosing Life Insurance for Over 50s

When selecting life insurance for individuals over 50, there are several key factors that need to be taken into account to ensure the policy meets their specific needs and circumstances. Factors such as age, health status, coverage needs, and financial situation all play a crucial role in determining the most suitable life insurance plan.

Additionally, the flexibility of policy terms and conditions is essential for this age group to accommodate any changes that may occur in the future.

Age

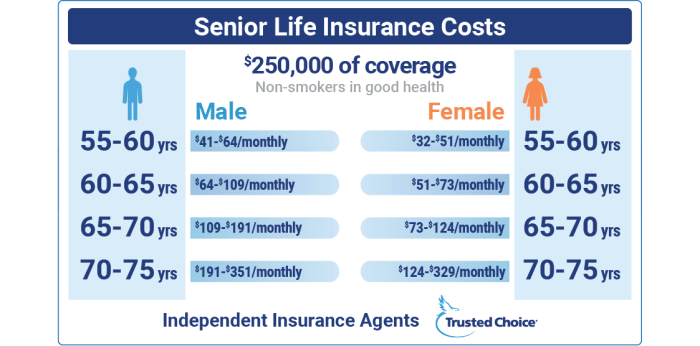

As individuals age, the cost of life insurance typically increases due to higher perceived risk by insurance companies. Therefore, it is important for individuals over 50 to consider purchasing a policy sooner rather than later to secure more affordable rates.

Health

Health status is a significant factor in determining life insurance premiums. Pre-existing medical conditions or poor health can lead to higher premiums or even denial of coverage. It is crucial for individuals over 50 to disclose any health issues honestly and accurately when applying for life insurance.

Coverage Needs

The amount of coverage needed will vary depending on individual circumstances such as outstanding debts, financial dependents, and future financial goals. Individuals over 50 should carefully assess their coverage needs to ensure their loved ones are adequately protected in the event of their passing.

Financial Status

Financial stability and income level play a role in determining the affordability of life insurance premiums. Individuals over 50 should consider their current financial situation and how much they can comfortably afford to pay for life insurance without compromising their overall financial well-being.

Flexibility in Policy Terms and Conditions

For individuals over 50, having flexibility in policy terms and conditions is crucial. This includes options for adjusting coverage amounts, premium payment schedules, and the ability to convert or extend the policy if needed. Flexibility ensures that the life insurance policy can adapt to changing circumstances and needs as individuals age.

Types of Life Insurance Suitable for Individuals Over 50

When it comes to choosing life insurance for individuals over 50, there are several options available that cater to their specific needs and financial goals. Two popular choices are term life insurance and whole life insurance, each with its own set of features and benefits.

Additionally, universal life insurance offers a unique approach that may be of interest to this age group. Furthermore, no medical exam life insurance provides a convenient alternative for those who may have health concerns or prefer a simplified application process.

Term Life Insurance vs. Whole Life Insurance for Over 50s

- Term Life Insurance:

- Provides coverage for a specific period, such as 10, 20, or 30 years.

- Usually has lower premiums compared to whole life insurance.

- Does not build cash value over time.

- May be suitable for individuals looking for temporary coverage or to cover specific financial obligations.

- Whole Life Insurance:

- Offers coverage for the entire life of the insured.

- Builds cash value over time, which can be borrowed against or withdrawn.

- Premiums are typically higher but remain level throughout the policyholder's life.

- May be ideal for individuals seeking permanent coverage and potential cash value accumulation.

Universal Life Insurance for Over 50s

Universal life insurance is a flexible permanent life insurance option that combines death benefits with a savings component. Unlike whole life insurance, universal life insurance allows policyholders to adjust their premiums and death benefits according to their changing needs. This type of policy offers the potential for cash value growth based on prevailing interest rates.

For individuals over 50, universal life insurance can provide a customizable and adaptable solution to long-term financial planning.

Benefits of No Medical Exam Life Insurance for Individuals Over 50

No medical exam life insurance policies offer a convenient and expedited application process without the need for a medical examination. This can be beneficial for individuals over 50 who may have pre-existing health conditions or prefer to skip the traditional underwriting process.

These policies typically have higher premiums compared to standard life insurance but provide a quick and hassle-free way to secure coverage. No medical exam life insurance can be a suitable option for those looking for immediate protection or who have difficulty qualifying for traditional policies.

Top Insurance Companies Offering Affordable Life Insurance for Over 50s

When it comes to finding affordable life insurance for individuals over 50, it's essential to consider reputable insurance providers that offer competitive coverage options. Below are some top insurance companies known for providing affordable life insurance to individuals in this age group.

Company A

- Coverage Options: Company A offers a range of coverage options tailored to individuals over 50, including term life insurance and whole life insurance.

- Premiums: The premiums offered by Company A are competitive and affordable for older individuals looking to secure their financial future.

- Customer Reviews: Customer reviews for Company A highlight their excellent customer service and prompt claims processing.

- Financial Strength: Company A has a strong financial standing, ensuring policyholders can rely on them for long-term coverage.

Company B

- Coverage Options: Company B specializes in providing life insurance options specifically designed for individuals over 50, with customizable features to suit different needs.

- Premiums: The premiums offered by Company B are competitive and affordable, making it a popular choice among older individuals seeking life insurance coverage.

- Customer Reviews: Customers praise Company B for their transparent policies, easy claims process, and responsive customer support.

- Financial Strength: Company B boasts a solid financial foundation, giving policyholders peace of mind knowing their coverage is secure.

Company C

- Coverage Options: Company C offers a variety of life insurance options for individuals over 50, including term life and permanent life insurance with flexible payment plans.

- Premiums: Company C provides affordable premiums that cater to the budget of older policyholders without compromising on coverage benefits.

- Customer Reviews: Customers appreciate Company C for their personalized service, knowledgeable agents, and hassle-free claims process.

- Financial Strength: Company C is known for its strong financial stability, ensuring policyholders can trust in their ability to fulfill future claims.

Trends and Changes in the Life Insurance Industry for Over 50s in 2025

In 2025, the life insurance industry for individuals over 50 is experiencing significant trends and changes driven by various factors such as technological advancements, economic conditions, and regulatory changes.

Advancements in Technology Driving New Insurance Products

Technology is playing a crucial role in shaping the development of new insurance products tailored for individuals over 50. Insurers are leveraging data analytics, artificial intelligence, and digital platforms to create more personalized and affordable life insurance solutions. These technological advancements allow insurers to better assess risk, customize coverage options, and streamline the application process, making it easier for older individuals to secure life insurance coverage.

Impact of Economic Conditions and Regulatory Changes

The economic landscape and regulatory environment have a direct impact on the life insurance offerings available to individuals over 50. Fluctuations in interest rates, inflation, and market conditions can influence premium costs, policy benefits, and overall affordability of life insurance for this demographic.

Additionally, changes in regulatory requirements and consumer protection laws may affect the types of products offered, pricing structures, and eligibility criteria for older policyholders.

Last Word

In conclusion, navigating the world of life insurance for individuals over 50 requires careful consideration and research. By understanding the factors at play, exploring the right types of policies, and choosing reputable providers, you can secure the best affordable coverage for your needs in 2025 and beyond.

FAQs

What factors should I consider when choosing life insurance for over 50s?

Key factors include age, health status, coverage needs, and financial situation. Flexibility in policy terms is crucial for this age group.

What are the benefits of no medical exam life insurance options for individuals over 50?

No medical exam options offer quick approval and are ideal for those with health issues or who want a hassle-free application process.

Which insurance companies are known for offering affordable life insurance to individuals over 50?

Reputable companies such as XYZ Insurance, ABC Life, and 123 Assurance are recognized for their affordable coverage options and reliable service.