A Breakdown of Business General Liability Insurance in 2025: Navigating the Future of Coverage

Delve into the realm of Business General Liability Insurance in 2025, where the landscape of coverage is evolving rapidly. This introduction sets the stage for a comprehensive exploration of key aspects that businesses need to consider for robust protection in the coming years.

The following paragraphs will shed light on the purpose, trends, coverage options, technological advancements, cost factors, and more, providing a holistic view of what lies ahead in the realm of insurance.

Overview of Business General Liability Insurance

Business General Liability Insurance is a crucial safeguard for businesses, providing protection against various liabilities that may arise during operations. In 2025, the need for comprehensive coverage has become even more essential due to evolving business landscapes and potential risks.

Purpose of General Liability Insurance

- General liability insurance serves to protect businesses from financial losses resulting from claims of bodily injury, property damage, or personal and advertising injury.

- It helps cover legal fees, settlements, and medical expenses that may arise from lawsuits or claims filed against the business.

Key Components Covered by General Liability Insurance

- Third-party bodily injury: Coverage for medical expenses and legal fees if someone is injured on business premises.

- Property damage: Protection in case the business causes damage to someone else's property.

- Personal and advertising injury: Coverage for claims of slander, libel, copyright infringement, or false advertising.

Importance of Having Business General Liability Insurance in 2025

- With the increasing digital presence of businesses, the risk of cyber threats and data breaches has grown, making liability insurance vital to mitigate potential losses.

- In the face of economic uncertainties and changing regulations, having comprehensive coverage can provide businesses with stability and protection against unforeseen events.

Trends and Changes in Business General Liability Insurance

In recent years, business general liability insurance has undergone significant changes and adaptations to keep up with the evolving landscape of risks and challenges faced by businesses. As we look ahead to 2025, several emerging trends are shaping the future of business general liability insurance, along with regulatory changes that are impacting the way coverage is provided.

Evolution of Business General Liability Insurance

Over the years, business general liability insurance has evolved from providing basic coverage for bodily injury and property damage to offering more comprehensive protection against a wide range of liabilities. Insurers have become more specialized in tailoring policies to address specific industry risks, such as cyber liability, product liability, and professional liability.

The digital transformation has also played a significant role in streamlining the insurance process, making it more efficient and accessible for businesses of all sizes.

Emerging Trends in Business General Liability Insurance for 2025

1. Cyber Liability Coverage

With the increasing threat of cyber attacks and data breaches, cyber liability coverage is becoming a standard inclusion in business general liability policies. As businesses rely more on digital data and online transactions, protecting against cyber risks is crucial for safeguarding sensitive information and maintaining customer trust.

2. Climate Change Risks

As the impact of climate change becomes more evident, insurers are reevaluating how they assess and underwrite risks related to natural disasters and extreme weather events. Business general liability insurance policies may see changes in coverage terms and exclusions to address the growing concerns around climate-related risks.

3. Litigation Trends

The legal landscape is constantly evolving, with new trends in litigation emerging that can impact the coverage provided by business general liability insurance. Insurers are closely monitoring legal developments to ensure that policies offer adequate protection against emerging liabilities, such as social inflation and reputational harm.

Regulatory Changes Impacting Business General Liability Insurance

Regulatory bodies are introducing new guidelines and requirements for insurers to enhance consumer protection and ensure the financial stability of the insurance industry. These changes may impact the pricing, coverage options, and claims process associated with business general liability insurance.

Insurers must stay informed and compliant with regulatory changes to maintain a competitive edge in the market while providing reliable coverage to policyholders.

Coverage Options and Limits

In business general liability insurance, coverage options and limits play a crucial role in protecting businesses from various risks and liabilities. Understanding the different coverage options available and how coverage limits are determined is essential for businesses to make informed decisions.

Types of Coverage Options

- General Liability Coverage: This includes coverage for bodily injury, property damage, and personal and advertising injury claims.

- Product Liability Coverage: Protects businesses from claims related to products sold or manufactured by the business.

- Professional Liability Coverage: Also known as errors and omissions insurance, this covers claims of negligence or inadequate work.

- Cyber Liability Coverage: Covers expenses related to data breaches, cyberattacks, and other cyber risks.

Determination of Coverage Limits

- Coverage limits are determined based on the level of risk exposure faced by the business, the industry in which the business operates, and the size of the business.

- Insurance providers assess factors such as revenue, number of employees, and past claims history to determine appropriate coverage limits.

- It is important for businesses to set coverage limits that adequately protect them from potential liabilities without overpaying for unnecessary coverage.

Comparison of Coverage Options

- Traditional business general liability insurance policies typically offer standard coverage options such as general liability and product liability.

- Modern business general liability insurance policies may include additional coverage options such as cyber liability and professional liability to address evolving risks in the digital age.

- Businesses should carefully compare coverage options between traditional and modern policies to ensure they have comprehensive protection against a wide range of liabilities.

Technological Advancements and Business General Liability Insurance

Technology is rapidly transforming the landscape of business general liability insurance, bringing about significant changes in how policies are underwritten, risks are assessed, and claims are managed. One of the key technological advancements shaping the future of this industry is the integration of artificial intelligence (AI) and data analytics.

The Role of Artificial Intelligence in Underwriting

Artificial intelligence is revolutionizing the underwriting process in business general liability insurance by enabling insurers to analyze vast amounts of data quickly and accurately. AI algorithms can assess risk factors, predict claims likelihood, and personalize policies based on individual business needs.

This enhances efficiency, reduces human error, and allows insurers to offer more competitive rates to policyholders.

The Impact of Data Analytics on Risk Assessment and Claims Management

Data analytics plays a crucial role in improving risk assessment and claims management in business general liability insurance. Insurers can leverage data from various sources, such as historical claims data, industry trends, and even social media, to gain insights into potential risks and tailor coverage accordingly.

By utilizing advanced analytics tools, insurers can proactively identify emerging risks, mitigate losses, and streamline the claims process for faster resolution.

Cost Factors and Affordability

Business general liability insurance is a crucial investment for businesses to protect themselves against unexpected financial risks. However, the cost of this insurance can vary based on several factors.

Factors Influencing the Cost of Business General Liability Insurance

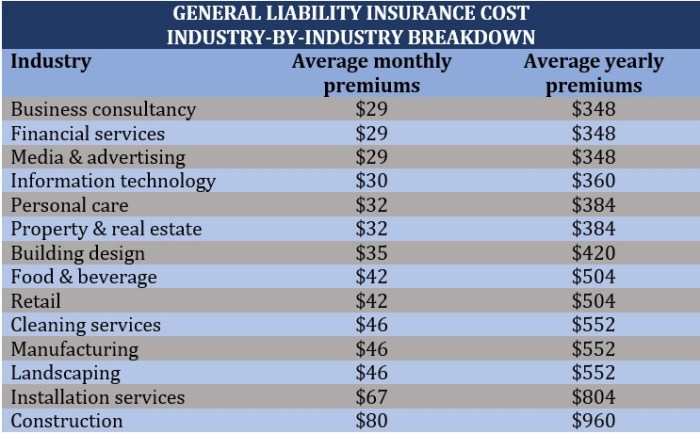

- The industry your business operates in: Some industries are considered riskier than others, leading to higher insurance premiums.

- Business size and revenue: Larger businesses with more revenue may face higher premiums due to increased exposure to liability claims.

- Claims history: A history of frequent or costly claims can result in higher insurance costs.

- Location: Businesses located in areas prone to natural disasters or with higher crime rates may face higher premiums.

- Coverage limits and deductibles: Opting for higher coverage limits or lower deductibles can increase premiums.

Strategies for Optimizing Insurance Coverage While Managing Costs

- Conduct a thorough risk assessment to identify potential liabilities and tailor coverage accordingly.

- Work with an experienced insurance broker to negotiate competitive rates and explore discounts.

- Implement risk management practices to reduce the likelihood of claims and demonstrate proactive risk mitigation to insurers.

- Consider bundling business general liability insurance with other types of insurance for cost savings.

Ensuring Affordability Without Compromising Coverage in 2025

- Regularly review and update your insurance coverage to ensure it aligns with your business needs and risk profile.

- Stay informed about industry trends and regulatory changes that could impact your insurance requirements.

- Compare quotes from multiple insurers to find the best coverage options at competitive rates.

- Invest in technologies that can help streamline insurance processes and reduce administrative costs.

Final Summary

In conclusion, A Breakdown of Business General Liability Insurance in 2025 unveils a dynamic future where innovation and risk management intersect. Stay informed, stay protected, and navigate the evolving insurance landscape with confidence and foresight.

Detailed FAQs

What are the key components covered by general liability insurance?

General liability insurance typically covers bodily injury, property damage, advertising injury, and personal injury.

How are coverage limits determined for business general liability insurance?

Coverage limits are usually based on the level of risk exposure and the financial capacity of the business.

What emerging trends can we expect in business general liability insurance for 2025?

Emerging trends may include more tailored coverage options, increased focus on cybersecurity risks, and innovative claims management solutions.

How can businesses optimize their insurance coverage while managing costs?

Businesses can optimize coverage by conducting risk assessments, implementing safety measures, and exploring bundled insurance options.

What role does data analytics play in risk assessment for business general liability insurance?

Data analytics helps insurers assess risks more accurately, leading to better pricing strategies and improved underwriting processes.