Managing Freelance Income with QuickBooks for Beginners sets the stage for this comprehensive guide, providing valuable insights for individuals looking to streamline their freelance income management process. From setting up QuickBooks to tracking expenses and generating financial reports, this guide covers it all in a structured and informative manner.

As we delve deeper into the intricacies of managing freelance income with QuickBooks, readers can expect to gain a solid foundation in utilizing this powerful tool effectively for their financial needs.

Overview of Freelance Income Management with QuickBooks

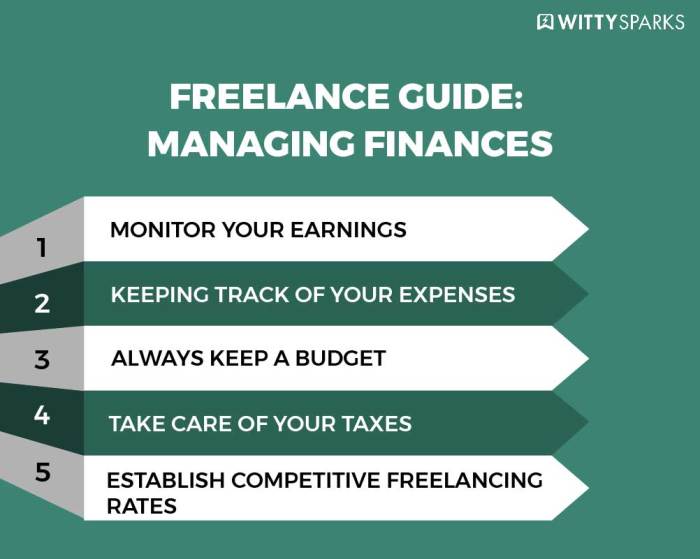

Managing freelance income is crucial for freelancers to ensure financial stability, track earnings, and plan for taxes. It helps in maintaining a clear picture of cash flow and expenses, allowing for better financial decision-making.

QuickBooks is a popular accounting software that can significantly assist freelance professionals in managing their income effectively. It offers features such as income tracking, expense categorization, invoice creation, and tax preparation tools, streamlining the financial management process for freelancers.

Key Benefits of Using QuickBooks for Freelance Income Management

- Automated Income Tracking: QuickBooks automates the tracking of income from various clients and projects, providing real-time updates on earnings.

- Expense Categorization: Freelancers can easily categorize and track expenses, ensuring accurate financial records for tax deductions and budgeting.

- Invoice Creation: QuickBooks allows for the creation and customization of professional invoices, making it easier to bill clients and track payments.

- Tax Preparation Tools: The software offers tax preparation tools that simplify the process of filing taxes and ensure compliance with tax regulations.

- Financial Reporting: QuickBooks generates detailed financial reports, giving freelancers insights into their financial performance and helping in making informed business decisions.

Setting Up QuickBooks for Freelance Income Management

Setting up QuickBooks for managing freelance income is crucial for keeping track of your finances efficiently. Here's a step-by-step guide on how to set up QuickBooks for freelance income tracking:

Step 1: Create Your QuickBooks Account

To begin, sign up for QuickBooks Online and create your account. Choose the subscription that best fits your freelance business needs.

Step 2: Customize Your Chart of Accounts

Customize your chart of accounts in QuickBooks to reflect your freelance income sources and expenses accurately. This will help you categorize your transactions effectively.

Step 3: Set Up Invoicing and Payment Options

Configure your invoicing templates in QuickBooks with your freelance business logo, payment terms, and preferred payment methods. This will streamline your invoicing process.

Step 4: Link Your Bank Accounts

Connect your bank accounts to QuickBooks to automatically import your transactions. This will help you reconcile your income and expenses seamlessly.

Essential Features in QuickBooks for Managing Freelance Income

- Income Tracking: Easily track your freelance income and categorize it for better financial management.

- Expense Tracking: Record your freelance business expenses to monitor your cash flow effectively.

- Invoicing: Create professional invoices and send them to your clients directly from QuickBooks.

- Reports: Generate financial reports to analyze your freelance business performance and make informed decisions.

Customizing QuickBooks for Specific Freelance Needs

Customize QuickBooks to suit your specific freelance needs by:

- Creating custom fields for tracking project details or client-specific information.

- Setting up recurring transactions for regular freelance income or expenses.

- Integrating third-party apps to enhance your freelance business management, such as time tracking or expense management tools.

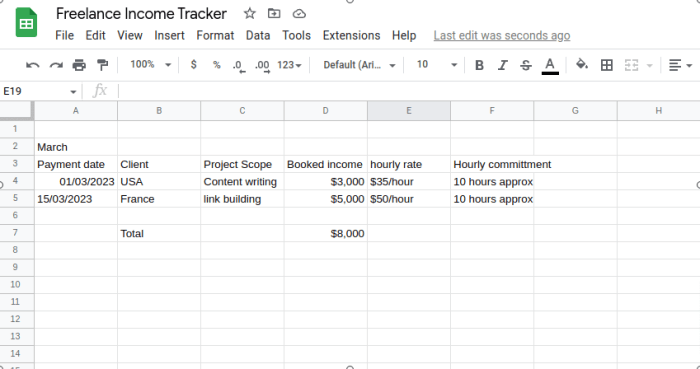

Tracking Income and Expenses

Tracking income and expenses is crucial for freelance professionals to maintain a clear financial picture of their business. QuickBooks offers a user-friendly platform to easily monitor and manage income and expenses, providing valuable insights for better financial decision-making.

Utilizing QuickBooks for Tracking Income and Expenses

- Input all sources of income into QuickBooks, including payments from clients, project fees, and any other revenue streams.

- Categorize expenses accurately by creating specific expense categories such as office supplies, utilities, travel expenses, and more.

- Regularly update income and expenses to keep financial records up to date and ensure accuracy.

- Utilize QuickBooks reports to analyze income and expenses trends, identify areas of overspending, and make informed financial decisions.

Effective Categorization of Income and Expenses

- Use subcategories within income and expense categories to provide more detailed information for tracking purposes.

- Ensure consistency in categorizing income and expenses to facilitate easy tracking and reporting.

- Review and adjust categories periodically to align with changing business needs and financial goals.

Importance of Reconciling Income and Expenses

- Reconciling income and expenses in QuickBooks ensures that all financial transactions are accurately recorded and accounted for.

- Helps identify any discrepancies or errors in financial records, allowing for timely corrections to maintain financial integrity.

- Provides a comprehensive overview of the financial health of the freelance business, aiding in strategic planning and forecasting.

Invoicing and Payments

Creating and sending invoices for freelance work is a crucial aspect of managing income effectively. QuickBooks offers a streamlined process for generating invoices, tracking payments, and managing accounts receivable efficiently.

Creating Invoices in QuickBooks

- Log in to your QuickBooks account and navigate to the Invoices section.

- Select the customer you are invoicing and fill in the relevant details such as services provided, rates, and due dates.

- You can customize the invoice template to include your logo, payment terms, and other important information.

- Once the invoice is ready, you can preview it, make any necessary edits, and then send it directly to the client via email.

Tracking Invoice Payments and Managing Accounts Receivable

- QuickBooks allows you to track invoice payments by marking them as paid once the client submits the payment.

- You can easily monitor outstanding invoices, overdue payments, and generate reports to analyze your accounts receivable status.

- Automated reminders can be set up to prompt clients for payment, helping you stay on top of your cash flow.

Best Practices for Streamlining Invoicing and Payment Process

- Regularly review your accounts receivable to ensure timely follow-up on overdue invoices.

- Utilize recurring invoices for clients with ongoing projects to save time on invoice generation.

- Integrate payment gateways with QuickBooks to allow clients to pay invoices online, speeding up the payment process.

- Keep detailed records of all invoices and payments for accurate financial reporting and tax compliance.

Generating Financial Reports

Generating financial reports is crucial for freelance professionals to monitor their income, expenses, and overall financial health. In QuickBooks, there are various types of financial reports available that can provide valuable insights into freelance income management.

Types of Financial Reports in QuickBooks

- Profit and Loss Statement: This report shows the income earned and expenses incurred during a specific period, providing an overview of the freelancer's financial performance.

- Balance Sheet: The balance sheet displays the freelancer's assets, liabilities, and equity at a specific point in time, giving a snapshot of their financial position.

- Cash Flow Statement: This report tracks the flow of cash in and out of the freelancer's business, helping them understand their cash position and liquidity.

Generating and Interpreting Financial Reports

- To generate financial reports in QuickBooks, freelancers can navigate to the Reports section and select the desired report type. They can customize the report by selecting the date range and other parameters.

- Interpreting key financial reports involves analyzing trends, identifying areas of improvement, and making informed decisions to optimize financial performance. For example, comparing income and expenses over different periods can help freelancers assess their profitability and make necessary adjustments.

Insights from Analyzing Financial Reports

- By analyzing financial reports in QuickBooks, freelance professionals can gain insights into their revenue streams, cost structure, and overall financial health. This information can help them make strategic decisions to increase profitability, manage cash flow effectively, and achieve their financial goals.

- Identifying patterns in income and expenses, tracking key performance indicators, and monitoring financial ratios can provide valuable insights for freelancers to optimize their business operations and drive long-term success.

Summary

In conclusion, Managing Freelance Income with QuickBooks for Beginners offers a roadmap for freelance professionals to navigate the complexities of financial management with ease. By implementing the strategies Artikeld in this guide, individuals can take control of their income and achieve greater financial stability in their freelance endeavors.

FAQ Guide

How can QuickBooks benefit freelance professionals?

QuickBooks helps freelance professionals in managing their income efficiently by providing tools for tracking expenses, creating invoices, and generating financial reports.

Is it necessary to reconcile income and expenses in QuickBooks?

Reconciling income and expenses in QuickBooks is crucial for maintaining accurate financial records and ensuring that all transactions are accounted for correctly.

What are the key features in QuickBooks for freelance income management?

Some key features in QuickBooks for freelance income management include customizable invoicing, expense tracking, and detailed financial reporting.

![[Infographic] 5 Key Workflow Automation Trends | Quixy](https://management.radarcirebon.tv/wp-content/uploads/2025/10/The-Rise-of-Workflow-Automation-5-Key-Trends-to-Keep-Your-Business-Ahead--120x86.png)

![Checklist: How to protect your digital life [PMP #136] - Paul Minors](https://management.radarcirebon.tv/wp-content/uploads/2025/10/checklist-protect-your-digital-life-120x86.jpg)

![Checklist: How to protect your digital life [PMP #136] - Paul Minors](https://management.radarcirebon.tv/wp-content/uploads/2025/10/checklist-protect-your-digital-life-350x250.jpg)